We dont recommend adding roommates however unless they are related or a spouse. For example say you insure your house for 100000 and your policy covers your property at 20 of that.

Understanding Your Certificate Of Insurance Harry Levine Insurance

This policy provides additional coverage compared to the basic fire policy for residential properties ie.

. Your personal property would be insured for up to 20000. Commercial property insurance which protects any real estate you might have or lease for your business. The definition of insured on an insurance policy includes dependents like children.

To be covered they would have to be listed on the policy. It also includes the spouse of the named insured. It also provides liability coverage.

An insurance policy that covers residential and commercial structures while they are under construction or being remodeled or renovated. Additional insurance protection that can be purchased to help cover the loss of jewelry watches and furs with values that exceed the personal property limit on a homeowners insurance policy. Your personal property and additional living expenses.

Certificate Holder Vs Additional Insured. If you are unsure if a family member is included in the definition of insured on your policy then your best bet is to contact the insurance company and ask them. This is an important distinction because as weve already discussed youre amending your prior coverage to additional coverage for the entity named.

Other types of property insurance. For homebuyers there are five basic types of mortgage loan options. The basis of assessing the true worth of your vehicle is its market value at the time of a loss.

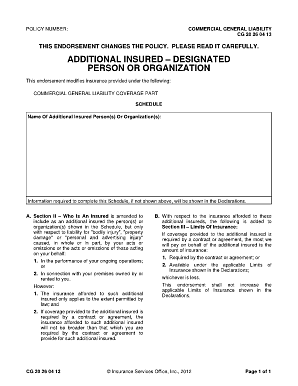

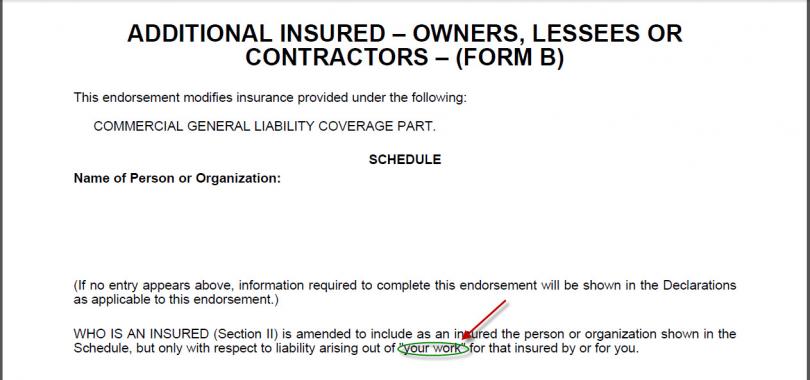

Conventional jumbo government fixed-rate and adjustable-rate. Renters insurance generally doesnt cover damage associated with your roommates belongings. An additional insured is an individual or organization that is insured under the business insurance policy you have purchased.

Contractors all risks CAR insurance is a non-standard insurance policy that provides coverage for property damage and third-party injury or damage claims the two primary types of risks on. Here is what to know about each. In other words the relationship looks like this.

Belongings inside your car at the time of the theft however are covered by renters insurance. The main difference between a condo owners HO-6 policy and a regular HO-3 homeowners insurance policy is that an HO-6 policy only covers the interior structure of a unit from the walls in Otherwise HO-3 and HO-6 policies are quite similar in how they cover personal property liability and additional living expenses. CVIN - Confidential Vehicle Identification Number.

Private dwellings condominiums apartments or flats. The party receiving additional insured status is the named party that contracts with the contractor. HO-6 is similar offering coverage for condo owners along with limited structural property coverage for the portions of the property specifically managed by the insured.

The final type HO-8 is designed to meet the higher costs of repairing older homes which may require materials that are more costly than those used in newer homes along with. You must make sure that your property is adequately insured at all times taking into account the renovations and enhancements made to your property. Builders Risk Coverage Form.

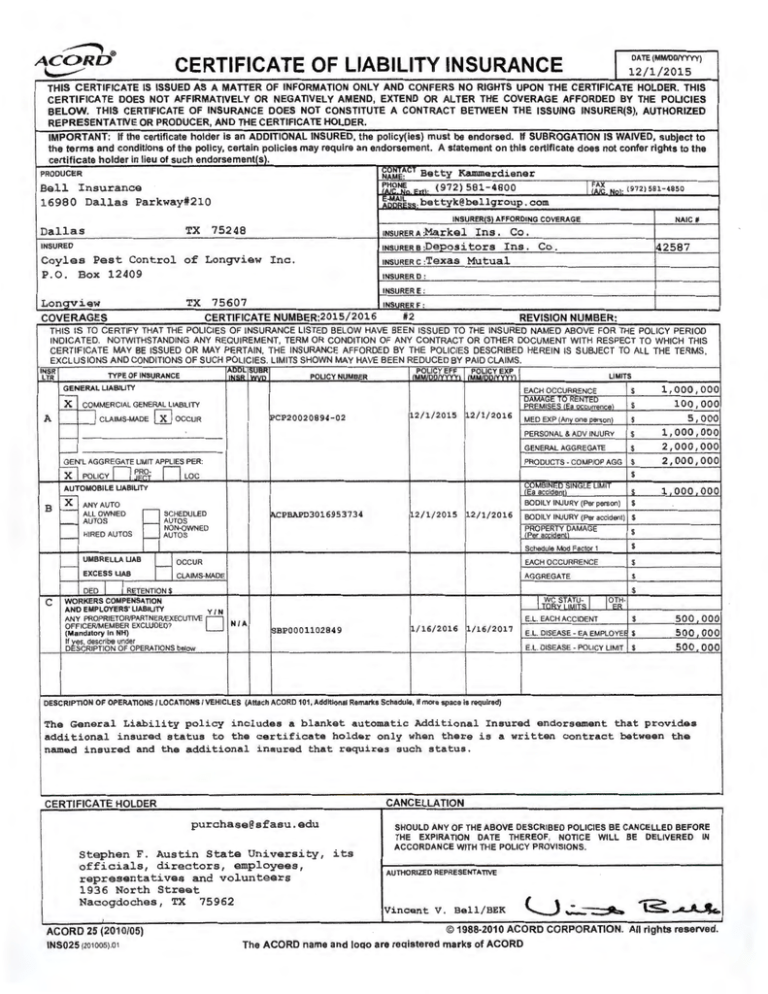

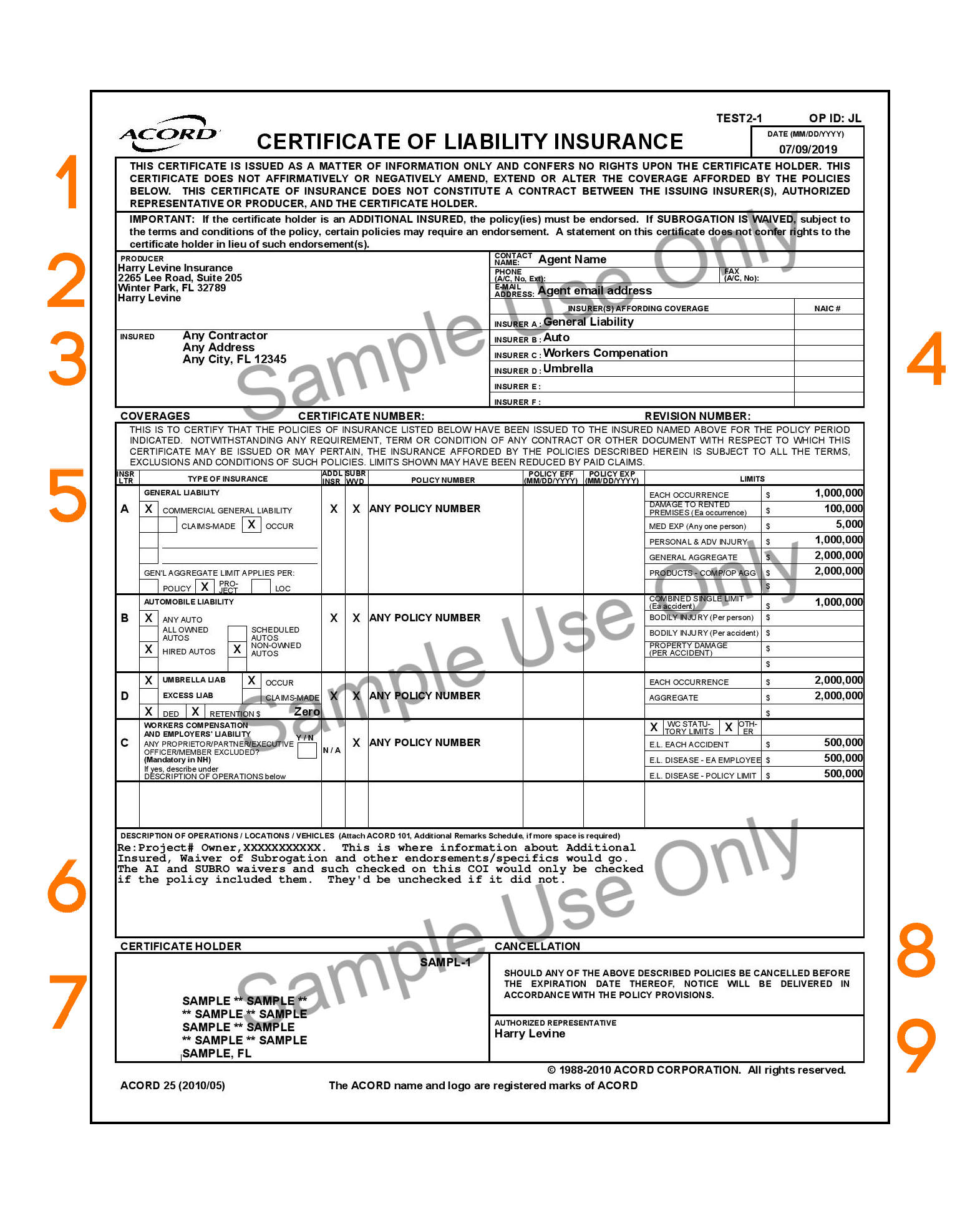

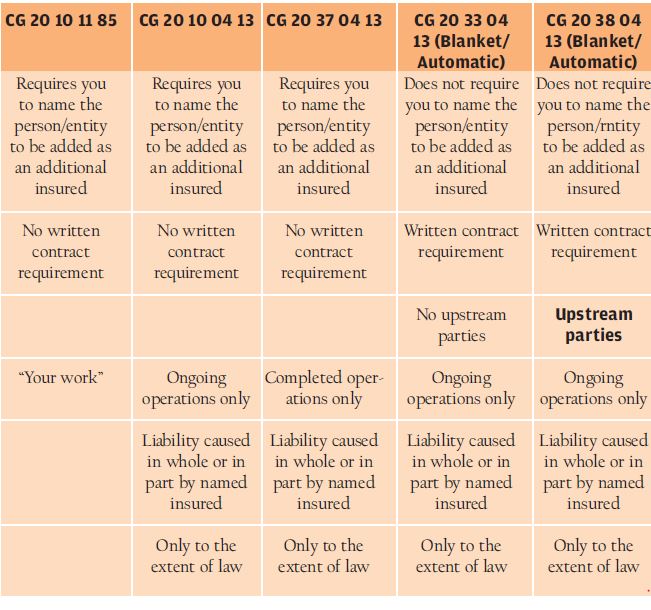

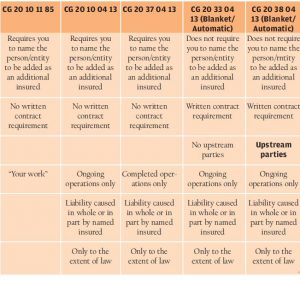

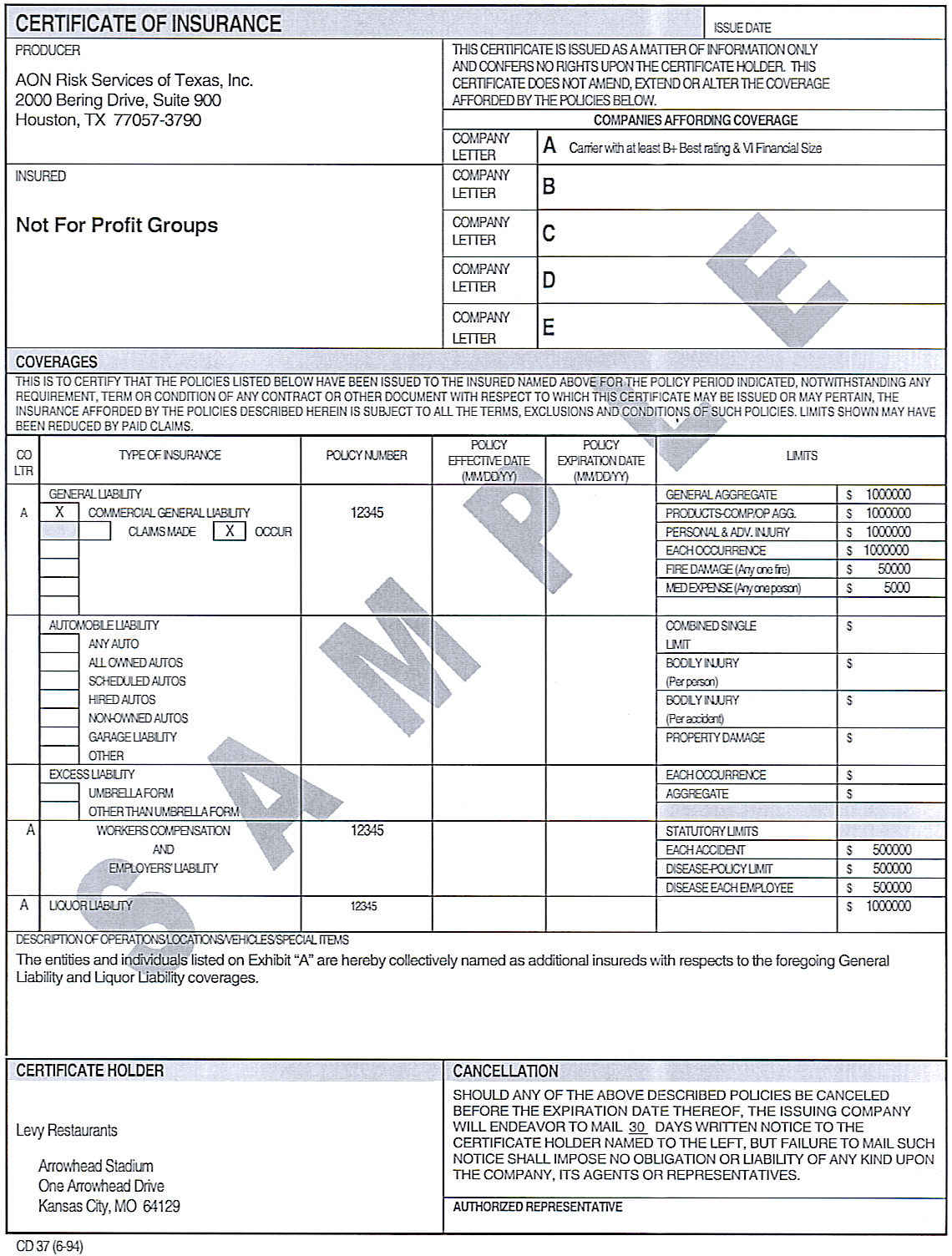

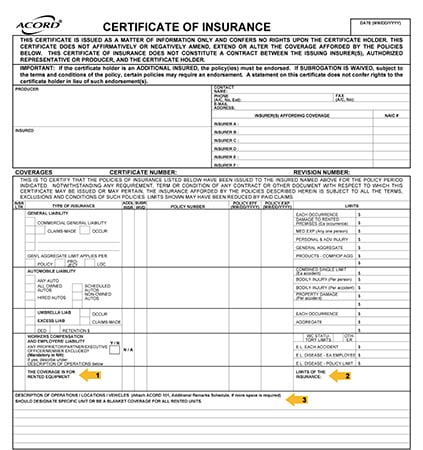

In property insurance a type of coverage. The market value must be within the Sum Insured. On COIs additional insured entities are indicated in these two ways.

The additional insured has the same coverage and is on the same policy as the named insured. CPT - Current Procedural Terminology. What does additional insured mean in renters insurance.

Additional Insured in Auto Insurance. CFR - Certificate of Financial Responsibility also known as an SR-22 COLL - Collision Coverage for Insured Vehicle Damages. Apart from the advantages of CCIPs mentioned above there are some downsides as well.

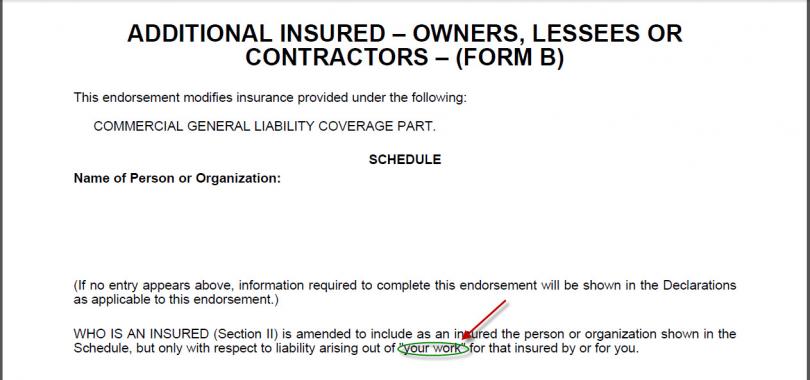

The Sum Insured of your vehicle is an estimated value for charging your insurance premium however it is also the maximum amount for which your vehicle is insured for. There is an automatic additional insured status provided to a party when a written contract requires the additional insured status. In renters insurance an additional insured is a person other than yourself whos listed on and covered by your policy.

Next on an additional insured. With property insurance any insurance benefit payments by the insurance. Often a landlord or property owner will ask to be listed.

However this can usually be resolved if the owner can be added to the policy as a named insured. The entity that does have the rights and authorization to make a claim is the additional insured. By an X or checkmark in the ADDL INSR box on the General Liability section of the COI andor the additional insured entity is named in the DESCRIPTION OF OPERATIONS section.

If the named insured dies from natural causes there is no coverage under this rider. Coverage under the endorsement is only permitted to the extent that it is allowed by law which can vary by state. What is an additional insured a policyholder and a certificate holder.

The policyholder or named insured is responsible for paying for the policy and receives coverage by default. CISR - Certified Insurance Service Representative. 1 the insured and 2 the insurance company.

Covered building components. Usually the dwelling and property coverage. There are two parties involved with a property insurance contract.

COMP - Comprehensive Coverage for Vehicle Theft Vandalism or Vehicle vs Animal. Examples of additional rights of the first named insured are the right to cancel the policy the right to initiate policy changes and the receipt of any. In some cases parties that contract directly with the owner instead of the contractor may not be able to enroll in the insurance program.

An additional insured is different from an additional named insured who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. An additional insured is not a policyholder.

The Basics Of Additional Insured Endorsements

Named Insured Vs Additional Insured Coverwallet

Certificate Of Insurance Wedsure

How To Read An Insurance Certificate Real Estate Nj

The Difference Between Named Insured Additional Insured And Named Additional Insured

What Is An Additional Insured Endorsement Cost Coverage 2022

Certificate Of Insurance Additional Insured Endorsement Mtmic

Are All Additional Insured Endorsements The Same The Oberman Companies

Understanding Certificates Of Insurance Thompson Smith

Insurance Card Geico This Is My Insurance Full Cover Geico That I Present In Card Templates Free Cards Printable Unicorn Invitations

Are All Additional Insured Endorsements The Same The Oberman Companies

Protecting Your Firm As An Additional Insured Virginia Independent Insurance Agent

Getting To Know Your Business Insurance Certificate Small Business Insurance Simplified

The Difference Between Named Insured Additional Insured And Named Additional Insured Leavitt Group Of Boise

Understanding Certificates Of Insurance Nh Business Review

Understanding Your Rights As An Additional Insured Florida Construction Legal Updates